accumulated earnings tax calculation example

Accumulated Earnings Tax. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

Sale Of Stock Of A Cfc Example Of The Potential Benefit Of Code 1248 B International Tax Blog

An S corporation with accumulated EP may be subject to corporate level tax on its excess passive investment income.

. Section 531 for being profitable and not. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. They are the amount of profit the company has reinvested in the business since its inception.

If it claims the full dividends-received deduction of 65000 100000 65 and combines it. Accumulated profit also known as retained earnings is the cash that remains after companies distribute dividends to their shareholders. TaxInterest is the standard that helps you calculate the correct amounts.

In a financially stable company if a company with a retained earnings balance of 10 million just generated 6 million in net income and paid 2. TaxAct helps you maximize your deductions with easy to use tax filing software. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

The parties disagreed on the correct tax computation and instituted the. Suppose that a US. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company.

Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Instead they are retained to be reinvested in a. The accumulated earnings credit allowable under section 535 c 1 on the basis of the reasonable needs of the business is determined to be only 20000.

Accumulated earnings and profits are less than the. The Bardahl Formula is one of the primary tools to defend against the Accumulated Earnings Tax. Accumulated Deficit Example Calculation.

RE initial retained earning dividends on net profits. The accumulated earnings of a firm are profits generated but not distributed to the shareholders as cash dividends or as corporate profit taxes. The Accumulated Earnings Tax IRC.

The rate for the accumulated earnings tax is the same as the rate individual taxpayers pay on dividends or 20. There is a certain level in which the number of earnings of C corporations can get. The formula for computing retained earnings RE is.

For example suppose a certain company has. If an S corporation with accumulated EP at the end of. It compensates for taxes which.

When the revenues or profits are above this level the firm. Calculation of Accumulated Earnings. Rather accumulated earnings demonstrate what a company did with its profits.

Its taxable income is 25000 100000 75000 before the deduction for dividends received. The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Ad Import tax data online in no time with our easy to use simple tax software. Up to 10 cash back 21. Accumulated earnings credit is the greater of the following two amounts.

It required the parties to compute the new tax liability based on the corporations holdings under the courts rule 155. Ad Import tax data online in no time with our easy to use simple tax software. The accumulated earnings tax is considered a penalty tax to those C corporations that have.

The value is part of a businesss balance sheet -. A computation of earnings and profits for the tax year see the example of a filled-in worksheet. TaxAct helps you maximize your deductions with easy to use tax filing software.

Accumulated earnings and profits are a companys net profits. RE Initial RE net income dividends. Breaking Down Accumulated Earnings Tax.

Accumulated earnings and profits E P is an accounting term applicable to stockholders of corporations. A 400000 distribution in year 6 will be sourced first from the current-year EP as shown in Exhibit 3. If a corporation pursues an earnings accumulation strategy where the accumulation is to avoid the tax on dividends rather than having a business.

Corporation has a book net income of 20 million 500000 of book depreciation 1 million of tax depreciation 500000 of earnings and profits. 250000 or 150000 for personal service corporations less the amount of accumulated earnings and. Of the 400000 distribution the current-year EP will cover the first 117000.

For example lets assume a certain company has 100000 in accumulated earnings at the beginning of the year.

Earnings And Profits Computation Case Study

Demystifying Irc Section 965 Math The Cpa Journal

What Are Earnings After Tax Bdc Ca

Demystifying Irc Section 965 Math The Cpa Journal

What Are Accumulated Earnings Profits Accounting Clarified

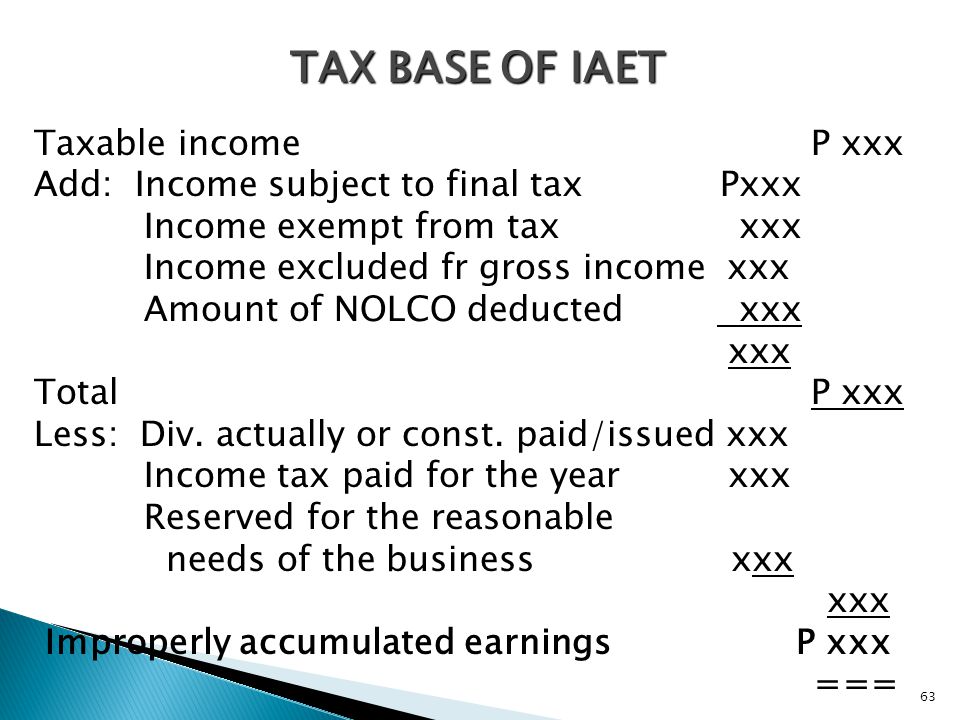

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Retained Earnings Formula And Excel Calculator

What Are Accumulated Earnings Definition Meaning Example

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Demystifying Irc Section 965 Math The Cpa Journal

Determining The Taxability Of S Corporation Distributions Part Ii

Earnings And Profits Computation Case Study

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Demystifying Irc Section 965 Math The Cpa Journal

Determining The Taxability Of S Corporation Distributions Part I

Earnings And Profits Computation Case Study

Determining The Taxability Of S Corporation Distributions Part Ii